Rethink° April

We take a look at the El Niño and La Niña phenomena, on ocean mining potential, and manage to weave in the viking Erik the Red. We rethink alternative forms of business and finance. Enjoy the read!

Ahoy there,

El Niño is taking the helm from La Niña over the coming months, but there is quite a lot to elaborate on regarding this shift, and it has to do with our oceans. So, we’ll dive straight into this topic before covering cooperatives and the latest report on “Banking on Climate Chaos”

El Niño and La Niña, Explained

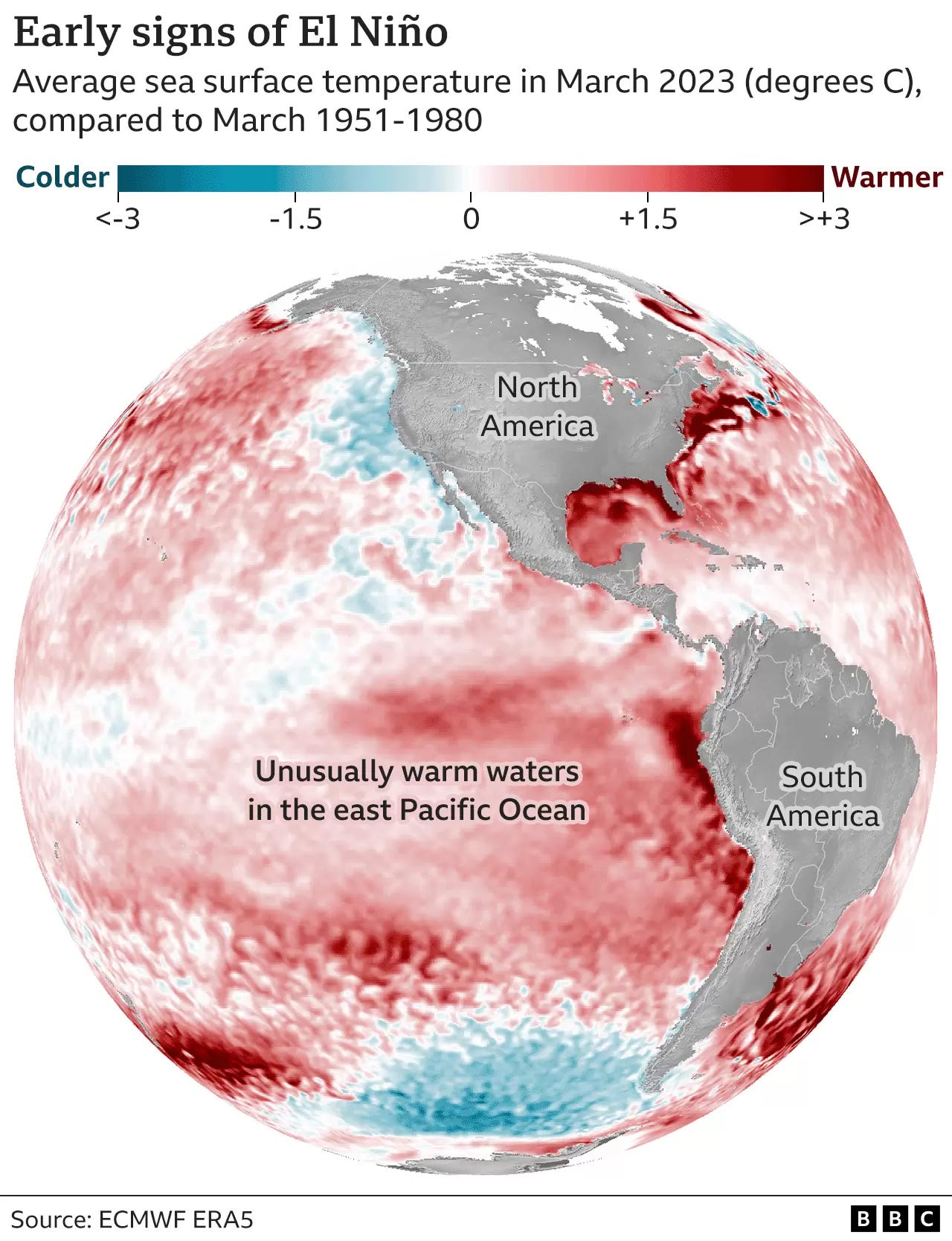

📰 Teaser: El Niño and La Niña are weather patterns that occur every two to seven years in the equatorial Pacific, affecting sea-surface temperatures and air pressure. El Niño brings warm water to the eastern Pacific, shifting the jet stream southward and causing cooler, wetter conditions in parts of the North and warm, dry conditions in Asia and Australia. La Niña brings cooler water to the eastern Pacific, shifting the jet stream northward and causing warmer, drier conditions in the Southern United States and wetter conditions in parts of Australia and Asia. The strength and frequency of these patterns may change as the world continues to warm from greenhouse gas emissions. Continue Reading → (4 min)

Recent, rapid ocean warming ahead of El Niño alarms scientists

📰 Teaser: Combined with other weather and climate events, like El Niño, the world's temperature could reach a concerning new level by the end of next year.

Climate predictions indicate that El Niño is developing over the equatorial Pacific. Warmer oceans lead to more extreme weather and raise sea levels. Continue Reading → (9 min)

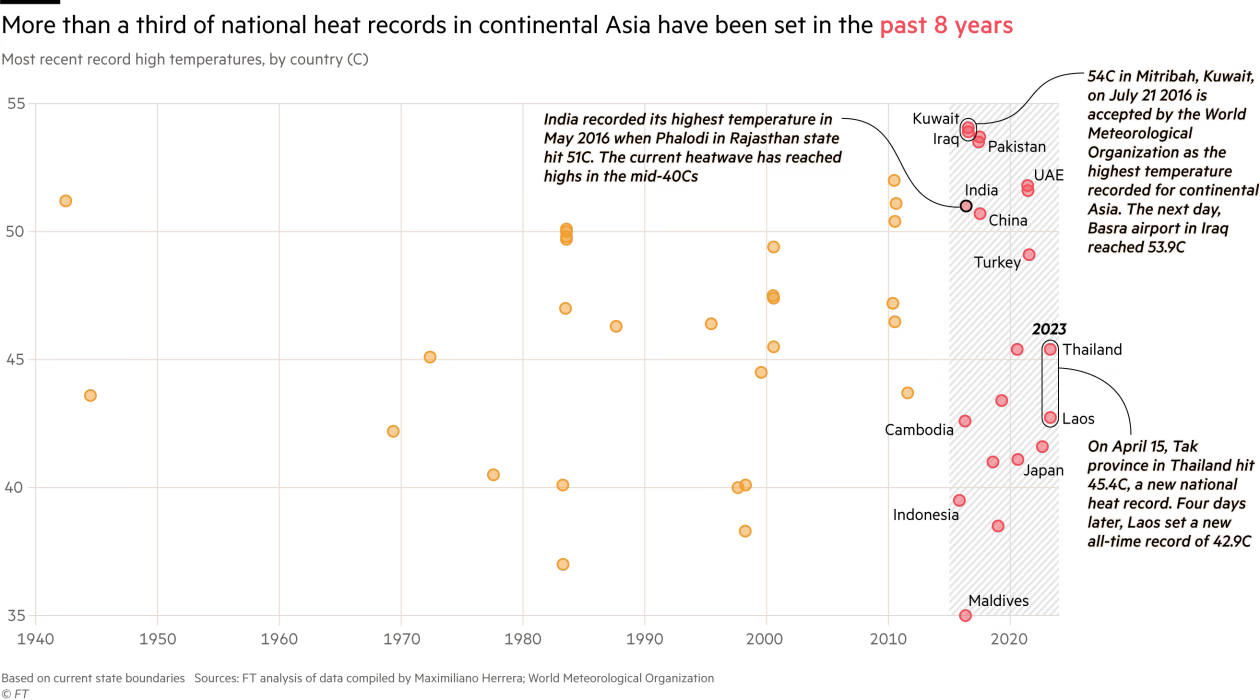

Asia’s prolonged April heatwave concerns scientists

📰 Teaser: Countries across Asia suffered soaring April temperatures, motivating warnings from scientists that 2023 could set new heat records as the cooler La Niña weather pattern is replaced by a hotter El Niño and global warming accelerates.

🤔 Max’s two cents: The heat wave in Asia is just one snapshot of the general trend of more frequent and extreme weather events globally. As extreme as the events already seem, with more wet-bulb events (high humidity combined with high temperatures), stronger storms, and long-lasting droughts, this unfortunately is only the beginning of what is to come due to climate change. Currently, we stand at around 1.2 °C of global average warming, but current projects point toward a likely warming of 2.6 to 2.9 °C warming by 2100 based on current policies and actions. Since there is no strict linear relationship between warming and extreme weather events, there is much worse to expect. While weather events such as El Niño and La Niña play a role in extreme weather events, the more profound influence comes from the rising concentration of greenhouse gases in the atmosphere. While we can influence the latter, the persistent climate inaction for the past five decades, highlights how challenging it is to drive systemic changes. Since our carbon budget for 1.5 °C is running low, and weather extremes are not yet sufficient to drive effect action, I am increasingly interested in more effective ways to drive system changes. The power of explicit and implicit narratives holds tremendous potential. Therefore, I find the latest Apple TV+ miniseries “Extrapolations” (think Black Mirror but for Climate Change), and Kim Stanley Robinson’s “Ministry for the future” useful mediums to communicate likely climate futures to a broad audience. It is events such as the current heat wave that highlight the need to view climate change with a social justice lens, and to use climate justice to raise the profile of climate adaptation relative to climate mitigation.

Here’s the real reason the Vikings left Greenland

📰 Teaser: From about 985 to 1450, a small population of Vikings farmed and built communities on the southern coast of Greenland, after Eric the Red had been exiled from Iceland. Why those settlements were suddenly abandoned around 1450 has been a point of speculation among historians and natural scientists. Now, a new study found some Viking settlements on Greenland experienced up to 10.8 feet (3.29 m) of sea level rise over four centuries. The multitude of difficulties the Vikings experienced can be compared to concerns we face now, as modern humans experience climate change on top of other social, political and economic challenges. We have the tremendous advantage of being able to learn from historic events such as this one, and of having a chance to mitigate the effects of climate change.

Continue Reading → (5 min)

🤔 Max’s two cents: As a former history-nerd, I remain fascinated by the similarities of past and present challenges, and possible takeaways to inform our decisions today. We are already facing social and political consequences spurred by the effects of climate change, and those are set to become more frequent and more extreme. Climatic changes have many prominent and instructive case studies for the collapse of societies from the Easter Islands to the Maya collapse, as extensively covered by Jared Diamond’s “Collapse: How Societies Choose to Fail or Succeed”. As rising temperatures lead to an accelerating thawing of glaciers, we are set to experience rising sea levels, similar to those experienced by the Vikings on Greenland. However, I hope that the current promising if tentative acceleration in climate action and climate justice will expand in light of the urgency for effective climate adaptation and actual decarbonization, to limit the detrimental social and political effects.

Unleash the deep-sea robots? A quandary as EV makers hunt for metals

📰 Teaser: As car manufacturers search for metals to build electric cars and accelerate the low-carbon transition, there has been growing interest in the deep seabed, which is rich in the minerals they need. However, efforts by mining companies to harvest these minerals with undersea robots are currently facing challenges, with diplomats and scientists sounding an alarm. Over 700 marine scientists have signed a petition demanding a moratorium, which is also supported by 13 countries. While some car manufacturers publicly support a moratorium on seabed mining, others are choosing to keep deep seabed materials out of their supply chain plans due to corporate concerns about environmental impact. Continue Reading → (11 min)

🤔 Max’s two cents: The growing pressure to allow deep-sea mining is concerning, especially given the limited understanding we currently have about ocean ecosystems. The possible risks are tremendous as oceans play a critical role in regulating our climate, weather, and are a crucial food source for around 3 billion people. The current governance organization tasked with managing the global seabed beyond national jurisdictions as “common heritage of all mankind” has a miniscule budget of around $17 million US, and has been involved in controversies before. Since we currently don’t manage to regulate high-sea fishing properly, expanding mining operations to the deep-sea where we lack fundamental understanding of the effects, and where monitoring and oversight is extremely limited, is not advisable. Instead of reproducing our current extractive economic system under the banner of decarbonization and sustainable development, we ought to question the need drivers for the more resources. We elaborated on degrowth before in this newsletter, and rethinking our economic system is necessary if we are to realize a climate-, ecosystem-, and socially safe, and thriving future. Replacing individual mobility with shared-mobility (car sharing and public transport) is a first step toward reducing the need for new resources.

The power of co-ops:

How Mondragon Became the World’s Largest Co-Op

📰 Teaser: Jorge Vega Hernández, a mechanical engineer working in northwestern Spain, returned from a business trip and started to feel sick. It was March 2020—the beginning of the pandemic—and so he called a government help line. He was told that he might have the coronavirus and that he should stay home. But, without leaving the house for a test, Hernández couldn’t get proof of his illness—and, without that proof, he had no excuse for not coming to work. A week after he got sick, he said, his company terminated his employment. (The firm cited “insufficient” job performance as the motive.) Continue Reading → (15 min)

🤔 Moritz’ two cents: We require different forms for making business. Forms that are less driven by profit motives and more by collaboration. Critiques are quoted in the article saying, “When you put workers in charge of firms, and you give them substantial control over the firms, the one thing you do not get is expansion. You get more for the people who are already there.” Despite, Mondragon contradicting this argument, if we’d be shifting more towards that direction, would that be a problem? With the rich getting richer, “more for the people who are already there” does sound appealing to me. Another great example of a co-op is the most sustainable bank in Germany, the GLS. The relatively cheap housing in Vienna is also created through a coop structure. I think, coops are a great tool to truly democratize business.

And ending with a quote from the article:

“It’s easy to assume that such arrangements must impair productivity. But multiple academic studies have found that coöperatives with worker governance and ownership are as profitable as or more profitable than ordinary firms.”

A new Report is out: Banking on Climate Chaos

📰 Teaser: The world’s 60 biggest banks poured over $5,500,000,000,000 (5.5 Trillion) over 7 years into the fossil fuel industry, driving climate chaos & causing deadly local community impacts. This report adds up financing (lending and underwriting of debt and equity issuances) from the world’s 60 biggest banks for the fossil fuel sector as a whole, as well as for top expanders of the fossil fuel industry and top companies in specific sectors. Continue Reading → (absolutely worth your time)

🤔 Moritz’ two cents: This report shows what’s going on in our financial system. Many of the big banks are! This is actually how I got started with sustainable finance. I looked at banks and thought, if the powerful players of our (financial) economy finance industries that destroy our future, how are we supposed to go into the right direction as a global economy? Our future will be what we are financing today. If we put down 5.5 Trillion US$ for fossil fuels within 7 years after the Paris Agreement, there’s not much to add…

Funding Gap of over US$ 5.5 Trillion

That reads like a big joke now, right? The money we lack in funding for climate tech is there – just invested in fossil fuels.

Not yet enough? Here are some evergreens and recent content we came across:

🇪🇺 The European State of the Climate 2022 report has been published, based on data from the Copernicus Sentinel-3 data.

📈 Data is created, not found. It can never be objective in the true sense. Creating it well required humanity rather than objectivity.

📺 Extrapolations is a miniseries on Apple TV+ with each episode covering a realistic aspect of our likely, near term climate futures. Watch it or read about the series here!

🌳 Nature-based solutions such as tree-planting need to consider biodiversity to be effective.

⛽️ Fossil fuel groups hit extra hard by divestment pledges that go viral on Twitter of all places, according to a recent study.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

📅 Rethinking is timeless. Read the March issue.

You come across something we might want to read/listen/watch? Send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe and share.

All the best, and keep rethinking,