Rethink° August

🌪️🔥⛈️🌡️ This past summer provided us with a glimpse of the climate risks that we can expect to face in the upcoming decades, and we asked, “What's going on with Worldcoin?”

Our banner astronaut is setting the tone. In the face of climate risks, (s)he had to leave the relaxed sunny island and is now taking a (climate-neutral sailing) trip across the ocean, trying to escape climate risk. But what is (s)he running from? And is (s)he actually a human being? And if so, how could she prove it?

That’s what we are looking at in this month’s episode.

What’s going on with Worldcoin?

Thanks to ChatGPT, every bot on the internet can now pretend to be a human (and even pass the Turing Test). So, there must be a new, tamperproof way to prove you are a human on the internet. That is what Worldcoin does. The Open AI Founder Sam Altman and the team around Worldcoin CEO Alex Blania have developed a technology for digital identity.

How to create a digital identity?

If you want to prove you are a human with Worldcoin (and receive a world-id), you must go to an “Orb” and get your iris scanned. The people at the orb will make sure you are a human, and you will receive a world-id. This ID is stored on a blockchain (Moritz cheering) and lets you show everyone on the internet: “I am a human; this digital document proves it.” This is a so-called “Zero-Knowledge-Proof,” and it’s great. The technology enables me to tell you that I am a human without telling you which human I am (that’s the difference to your government ID Cards).

Why is it important?

Trust and security. The internet is full of bot-armies trying to manipulate opinions, scammers, and the like. A countermeasure for social media platforms would be to have everyone identified. But imagine now that Meta has another data leak, and instead of leaking your mail & phone number, they had also leaked your passport that you uploaded to prove that you are not a bot. Yikes!

It is better to be able to use a zero-knowledge proof – granting only the data necessary for verification. That is precisely what Worldcoin does.

Deep Thoughts & Critics:

Moritz’ first reaction: Gosh, that sounds dystopian, a private company controlling our IDs to prove that we are human. But when looking at the whitepaper, the whole thing starts to look different. There is a plan to decentralize the entire thing (into a DAO – decentralized autonomous organization). That could give control to the people (and still make founders and early investors rich, thanks to holding tokens). So, if that becomes true, it is far less dystopian than it seems and could turn into a utopian technology that could even grant world citizens a universal basic income.

I will spare you more thoughts and recommend you read Vitalik Buterins's take on it. Read more here (→ 23 min). It’s worth it.

What if we slapped carbon taxes on shareholders, not consumers?

📰 Teaser: What if, instead of focusing on consumption, carbon taxes addressed greenhouse gases as an outcome of profit generation?

Most American corporations operate under the principle of “shareholder primacy,” where they see the fiduciary duty to maximize profit for their investors. Products – and the greenhouse gases used to make them – are not created for the consumer's benefit but because the sale of those products will benefit the shareholders.

If carbon taxes were focused on shareholder income linked to greenhouse gas emissions rather than consumption, they could target those receiving the most economic benefits resulting from these emissions.

Continue Reading → (4.5 min)

🤔 Moritz’s two cents: Carbon taxes are slapped onto consumers because they are most often linked to the products, not the firms (consumer tax vs. taxing a firm’s profit). My favorite sentence is in the teaser. I enjoy that idea because even if the company only wanted to reduce taxes, they’d still have to act according to the tax idea. Another similar idea is a carbon (and also biodiversity, pollution, etc.) tax on investment income. Because this is where the strategic, future decisions are made – among the shareholders – so this is where to steer them. This would also be a tax aiming at the rising wealth inequality, with a pretty sound argument to make:

If higher investment income means you benefit more through pollution, you’ll pay higher taxes.

The Trillion-Dollar Auction to Save the World

📰 Teaser: Seagrass is a humble ocean plant, potentially worth trillions of dollars. It is one of the most effective ways to fight the climate crisis and is crucial to the world's ecosystems. Seagrass meadows also help protect shorelines from erosion and provide food for local communities. However, seagrass meadows are disappearing at an alarming rate due to human activities such as coastal development and pollution.

Continue Reading → (30 min)

🤔 Max’s two cents: Carbon credits have received their fair share of criticism recently. After the hype phase began soon into the COVID-19 pandemic, along with rising demand for ESG investing, scandals have brought to light the present shortcomings of offsets. A sound methodology ascertains the additionality of the credit that the sequestered carbon would not have been sequestered anyway and accounts for the time that the carbon has been removed or emissions omitted. Given a trustworthy methodology, carbon credits can be a vital source to close the billion-dollar funding gap in climate finance. This article provides a critical but balanced take on blue carbon credits, particularly for seagrass. Given the disregard for the ocean as a valuable ecosystem worth protecting, its role in the carbon cycle has been negligible despite its vital role in the global carbon cycle. There is a growing interest in leveraging market mechanisms, such as carbon credits, to finance the conservation and restoration beyond the globe’s landmass. The challenges for blue carbon credits remain the same as for conventional carbon credits: capturing the complexity of eco- and climate system dynamics while balancing narrow commercial incentives that push for simplistic and weak standards. Putting a price on nature is difficult, if not impossible, because money cannot compensate for all the lost ecosystem services (beyond carbon value) that even the smallest plant or animal provides. Showcasing how valuable, even with inadequate methodologies, nature might, however, help broaden our view of it. We might slowly accept that we cannot quantify it adequately in monetary terms and instead begin to value it for the vital system we humans are just a tiny but consequential part of. Meanwhile, let’s use high-quality carbon credits to channel money toward conservation and decarbonization efforts.

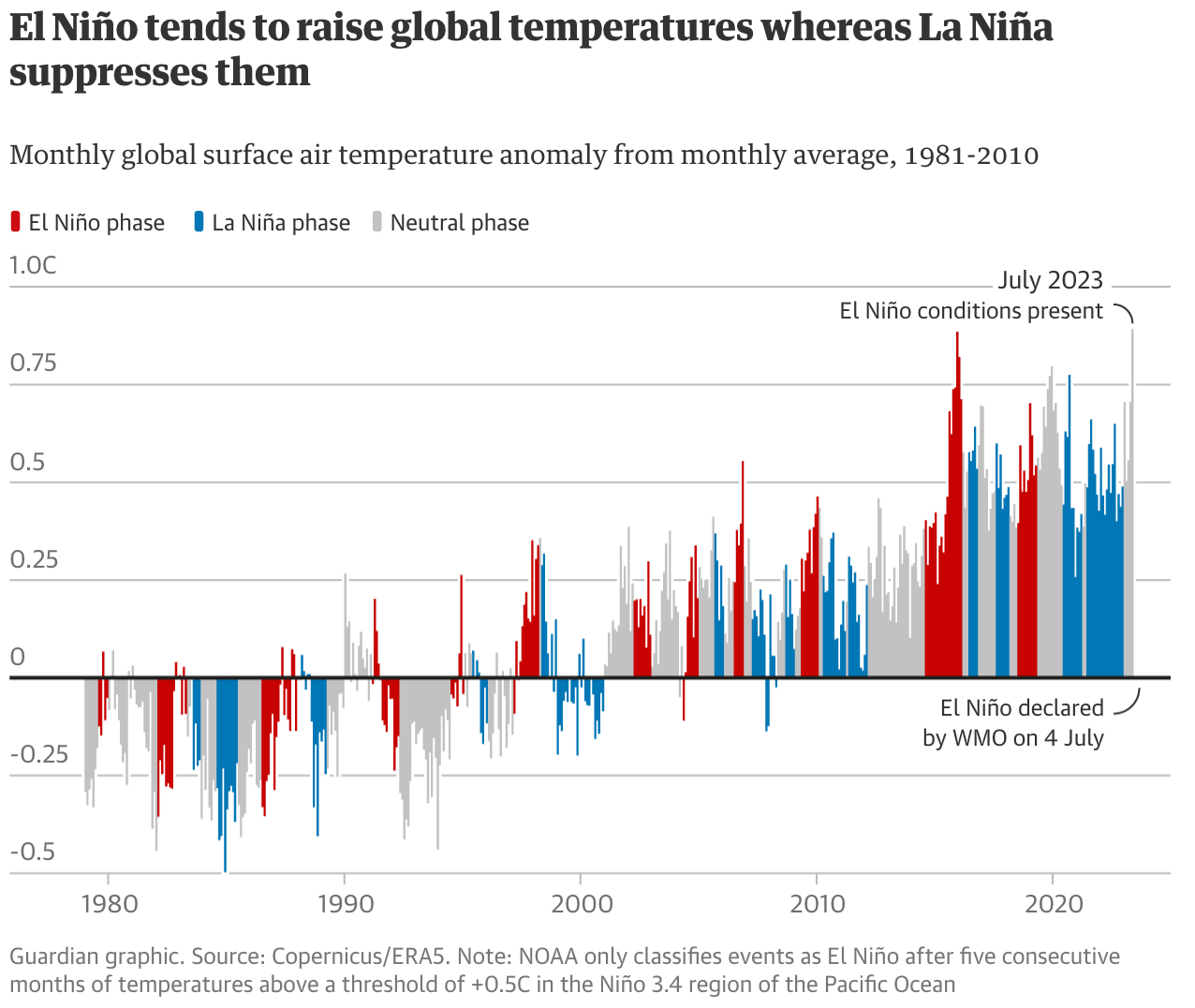

‘Off-the-charts records’: Has humanity finally broken the climate?

📰 Teaser: In 2023, the world witnessed devastating heatwaves, wildfires, and floods that affected countries such as the US, India, and China, among others. These events raised concerns about whether humanity's continuous carbon emissions have pushed the climate crisis into an even more destructive phase. The natural occurrence of El Niño temporarily intensified global heating, contributing to this feeling of entering a new age of devastation. Additionally, many people experienced extreme weather conditions they had never encountered before, highlighting the significant impact of climate change on usual weather patterns.

“I do think we are hitting a tipping point in global consciousness, (…). For years, I’ve spoken about the challenge of psychological distance: when people are asked if they are worried about climate change, they say yes; but when asked if it affects them, they say no. That barrier is falling very quickly as nearly everyone can now point to someone or somewhere they love that is being affected by wildfire smoke, heat extremes, flooding, and more.” - Prof. Katharine Hayhoe, chief scientist at the Nature Conservancy

🤔 Max’s two cents: It is unequivocal that the scale and rapid succession of climate-change-induced calamities foreshadow the future for humanity as we continue toward ever-rising GHG emissions. What we are experiencing now is only what 1.2 degrees of warming causes. Unfortunately, we are nowhere close to achieving the Paris Climate Agreement goal of limiting global warming to 1.5 degrees of warming by 2100. Even this target seems not ambitious enough, seen through the lens of climate risk. It was set back in 2015 due to political haggling and the idea that warming beyond 1.5 degrees would result in unmanageable climate risks. As we experience today, we might be in an unmanageable situation already. In theory, many ways exist to mitigate and adapt to climate risks, such as sponge cities, urban greening, or restoration of coral reefs and mangrove forests. Yet, we are falling short of providing sufficient funding for climate adaptation. Developing countries alone are estimated to require as much as $340 billion a year by 2030 for climate adaptation. Yet, such funding stands at less than one-tenth of that amount. The same holds true for disaster risk reduction (DRR) funding, which reduces vulnerability to calamities (not just climate-change-induced ones!). Governments and other donors spent $5.2 billion on DRR from 2005 to 2017; this represents a mere 3.8% of the total humanitarian financing. Roughly 90% of international funding for disasters goes toward recovery work, leaving a bit more than 10% for prevention. This means that while, in theory, it is likely that at 1.2 degrees of warming, climate risks could be manageable. Socioeconomic inequality undermines such efforts and amplifies the impact on the marginalized, who contribute the least to climate change in the first place. Let’s hope that 2023 is a wake-up call for humanity to start acting decisively on reducing emissions, even though just in this very year; major oil companies have stepped back from even underwhelming decarbonization plans.

📚 Rethink° Book Club

Please share with us what you are reading.

Moritz: I just finished a German book on emotions called “Besser fühlen” (Feeling Better) by Dr. Leon Windscheid. It’s a nice update of some facts I had in mind. For example, there is a salary from which an additional earned dollar does not make you any happier. It is around 90,000 USD (depending very much on the region). The last number, I remembered, was 75,000 USD. It seems like it’s only corrected by inflation. And I found this episode’s quote in the book.

Max: I just finished reading “The Art of Power” by Thich Nhat Hanh, one of the founding monastics of Plum Village, where I attend the Wake-Up retreat, which I can highly recommend. The book introduces the basics of the Zen Buddhist teaching of Thich Nhat Hanh and applies it to the concept of power in various contexts. We should redefine our conventional, materialistic understanding of power to focus on mindfulness and presence. Only by being present and aware of our current state of mind can we bring compassion, calm, and open-mindedness to addressing the global challenges of climate change and conflict. While this sounds a bit esoteric at first glance, I am convinced that more mindfulness would address most drivers of exploitation (both social and environmental). It centers us in the present moment and makes us appreciate what we already have; thus, it can decrease the need to pursue material or harmful expressions of power.

Send us your recommendations, and we’ll list the highlights: me@mjmey.com

Not yet enough? Here are some evergreens and recent content we came across:

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

🎥 Water Bear is a non-profit movie platform focused on advancing activism, as a Netflix for impact.

📔 Any open questions on degrowth? You might find an answer in this book: “The political economy of degrowth” with 850+ pages by Timothée Parrique.

📅 Rethinking is timeless. Read the July issue.

Have you encountered something we might want to read/listen/watch? Please send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe, and share.

All the best, and keep rethinking,