Rethink° February

Rethinking the distribution of power, green growth fantasies of a renowned economist and pondering thoughts on sustainable finance.

Dear all,

This issue starts with a piece on power! Not as much with becoming powerful, but with distributing power. If that is too heavy reading for you, you can easily skip that section and arrive at the curated content:

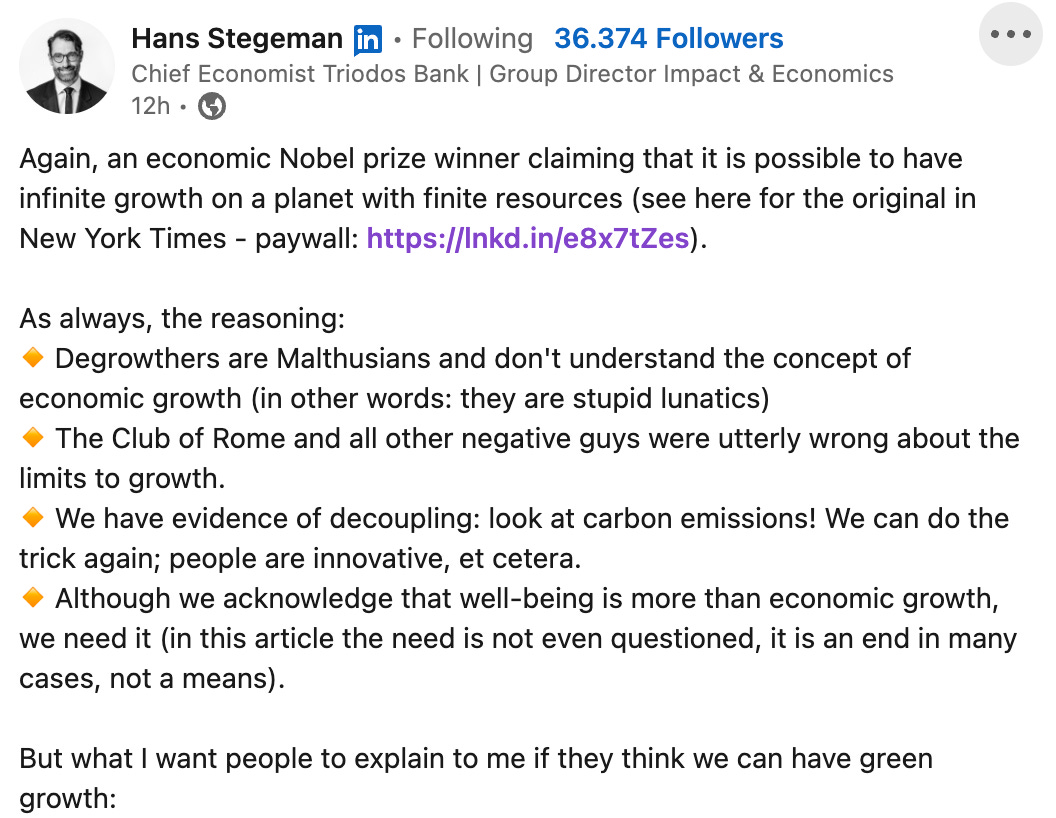

Hans Stegeman (Chief Economist Triodos) is taking a stance for degrowth, calling out the Nobel Memorial Prize winner Paul Krugman for his green growth fantasies

The war for climate talent is hotting up. Is big finance willing to change, or is it just silencing activists with well-paid jobs?

Divestment or engagement? A podcast on the impact on capital markets

Persistent challenges in Europe’s corporate climate transition and plans and their implications for the financial sector?

Continue investments in fossil fuels despite pledges, commitments, and basic science.

Rethinking institutions & power

Have you ever thought about the role central institutions play in your life? Everyone owns data on you. Your bank, your internet provider, the big great internet MAMAA (Meta, Alphabet, Microsoft, Amazon & Apple) or your health insurance. And that used to be… well kinda unavoidable. Want digital money? Bank account. Internet? Someone will give you access. Insurance? Well, a third party will have to manage the funds. A trusted third party is involved in nearly all transactions and contracts we do today.

But the paradigm could change—it started to do so in 2008. That was the first year an online transaction could be executed without a trusted third party. And you guessed right: we are referring to Bitcoin.

Not a fan of this centralization / decentralization discussion? Just jump ahead, there are other articles below that do not tackle this debate.

Energy consumption might be the first thing popping into your head right now. Fair. But let another thought sink in for a moment. Trusted third parties have 3 main downsides that we can now avoid:

Abuse of power

Ever heard of Wirecard? And that is only the most recent scandal. A trusted third party can only be regulated, but regulation cannot prevent the abuse of power. Radical transparency & distribution of power can.

> On a distributed ledger, power is scattered, and dependency on trusted third parties is minimized.Access limitation

17 % of the world’s population does not have access to the financial system. They are the so-called “unbanked population”. These people are hardest to reach – and more commonly, women, poorer, less educated, and living in rural areas. A permissionless financial system could be more inclusive.

> On a distributed ledger, no single entity controls access; they are generally permissionless and interoperableIssues in reliability, loss, and inaccessibility of data

A central institution can be a single point of failure and a single point of attack. When AWS goes down, the internet goes down, and when someone hacks Facebook - sorry, Meta - they’ll get user data of 530 Million users or more.

> On a distributed ledger, data is tamperproof, and as everyone manages their data, large-scale hacks are impossible.

Centralized Systems are efficient when it comes to their local implementation. But whenever we need to jump between systems, we lack efficiency—there is low interoperability.

As an example: ever tried jumping systems from one central party to another? I did (in 2019) a money transfer from a local German bank to a local Colombian bank that took over 3 weeks and cost a substantial amount of money. More generally speaking: the cost of a $200 remittance in a lower-income country averages over $13.16, or 6.58%. This is still more than double the maximum of 3% in the UN Sustainable Development Goals (Worldbank, 2021; MDP, 2021; UN, 2022).

Okay, as you’ve guessed by now—I (Moritz)—am a friend of decentralization. But I’d also be happy to speak about the downsides or go into some concrete solutions. Let us know.

❓ Want to learn the blockchain basics? Here’s a (free) introduction course to Blockchain. I took some of it as inspiration for a recent lecture & can recommend it.

🪙 Read more on crypto’s “ESG” in this article on coindex

🤝 Find out more on Moritz's favorite crypto-project, “Celo”. Just reach out to me, and I’ll be glad to tell you more.

Stegeman calling out Krugman for his green growth fantasies

📰 Teaser:

→ continue to read the post below in the two cents section.

M&M‘s two cents: Not much to add, in case you have not clicked Stegeman’s Post, yet that’s probably the best two cents to that article to add

Relevant Links from the Post: Stegeman’s Post, Nature has proven laws, Economic growth is finite, IMF

And of course, you can read Krugman’s opinion in the NY Times → read it [paywall] (5min).

(You can circumvent the paywall by interrupting the page load on time. 😉)

A war for climate talent is hotting up

📰 Teaser: In 2017, Eugenie Mathieu was a senior Greenpeace campaign strategist in New York, trying to stop ancient forests from being chopped down to make toilet paper. A year later, she was back in her home City of London, helping to run a natural capital investment fund at Aviva Investors, the asset manager. This is not a conventional career path in the City of London. At least, it wasn’t. As competition for green business experts grows, financial firms are snapping up staff from environmental non-profit groups at a pace — and price — that industry veterans say is striking… → continue reading (4 min) …

Moritz’s two cents: Financial firms increasingly hire staff from environmental non-profit groups as competition for green business experts grows. Environmental campaign groups are losing top talent to banks and fund managers who are offering high salaries.

Is that now a good development or a move by big finance to drain talent from environmental organizations?

I’d say it’s a good sign. Finance firms are paying environmentalists to help them turn their business around. Sounds superb to me. Surely, those people won’t be able to stand for the same radical beliefs they could before. But they might be able to bring far more change. Even small changes in the investment policies of BlackRock will have large global impacts. So go for it, folks; change finance from within.

Divestment or Engagement?

📰 Teaser: Divestment on the rise - hitting $40tn in 2022 - driven by people campaigning organizations they are connected with, e.g. universities, faith organizations, and pension schemes. But Bill Gates argues that “Divestment, to date, probably has reduced about zero tonnes of emissions".

This week, we are talking about divestment - the process of opting not to invest in areas such as fossil fuels. We look at whether divestment is the best approach for impact investors or whether sticking with the big polluters and engaging with them to change is the best approach. → listen to the podcast (20 min)…

Moritz’s two cents: One of the best pieces differentiating between the impact of divestment vs engagement I have seen/heard in a while. The two hosts of the Circa500 open up some interesting lines of thought. On divestment, they state:

All you are really doing is washing your hand. So on a net basis, what have you really changed?

The compelling argument for divesting is not investing in stranded assets for your own sake. On the other hand, “engagement” is often used to greenwash. Engagement policies can easily be used for that because you keep investing like you always do. Then you just don't engage sufficiently (something I have discussed with Niklas from Finance4Future recently).

If you invest a coal company, how much will engagement really do? Then it makes sense to divest.

The general problem on the public markets. It all comes down to the piles of cash you own. The bigger your pocket, the more material any of those actions is. See a general concern here? Centralization of power—just to refer you back to the beginning of the issue.

Stepping up - Strengthening Europe’s corporate climate transition

📰 Teaser: This report discusses the progress made by European companies in developing climate transition plans, with around half of the respondents reporting alignment with the Paris Agreement's 1.5 °C limit. However, less than 5% of companies show the advanced transition readiness required to achieve the Paris goal, and most fail to address the economy's impact on nature. Regulators in the UK and EU will soon require public transition plans and regular disclosures of progress. Governance is a key area where discrepancies exist, with almost all companies adopting board-level climate oversight but only half integrating climate KPIs into executive compensation. → continue reading (30 min) …

Max‘s two cents: This report is a call to action for financial institutions in particular, highlighting a significant gap between the climate commitments of financial institutions and those of their portfolio companies.

Out of the top 50 banks in Europe, 36 have committed to steeply reducing their financed emissions through the Net-Zero Banking Alliance. However, up to 20-40% of corporate debt belongs to companies with limited transition planning. These companies either lack decarbonization targets that align with a 2°C limit or have failed to disclose more than half of the CDP transition plan-related indicators.

At the same time, pending EU regulations (CSRD, CSDDD, and the last objectives of the EU Taxonomy) will make climate transition plans mandatory for financial and non-financial companies. Complying with these regulations will require banks to develop climate-aligned business models and new ways of engaging their clients in decarbonization efforts.

Currently, common commitments for net-zero portfolios by 2050 are woefully insufficient and usually too vague. It takes years for changes to the portfolio composition of financial institutions to translate into operational infrastructure. Yet this is precisely what is necessary for the carbon transition, as new environmentally friendly plants and green infrastructure need to be built. Therefore, net-zero portfolios need to be realized way before 2050. Around 2050 we ought to have reached net-zero emissions globally and enter net-negative emission territory to eventually stabilize the climate around 350ppm CO2 equivalent in atmospheric concentration.

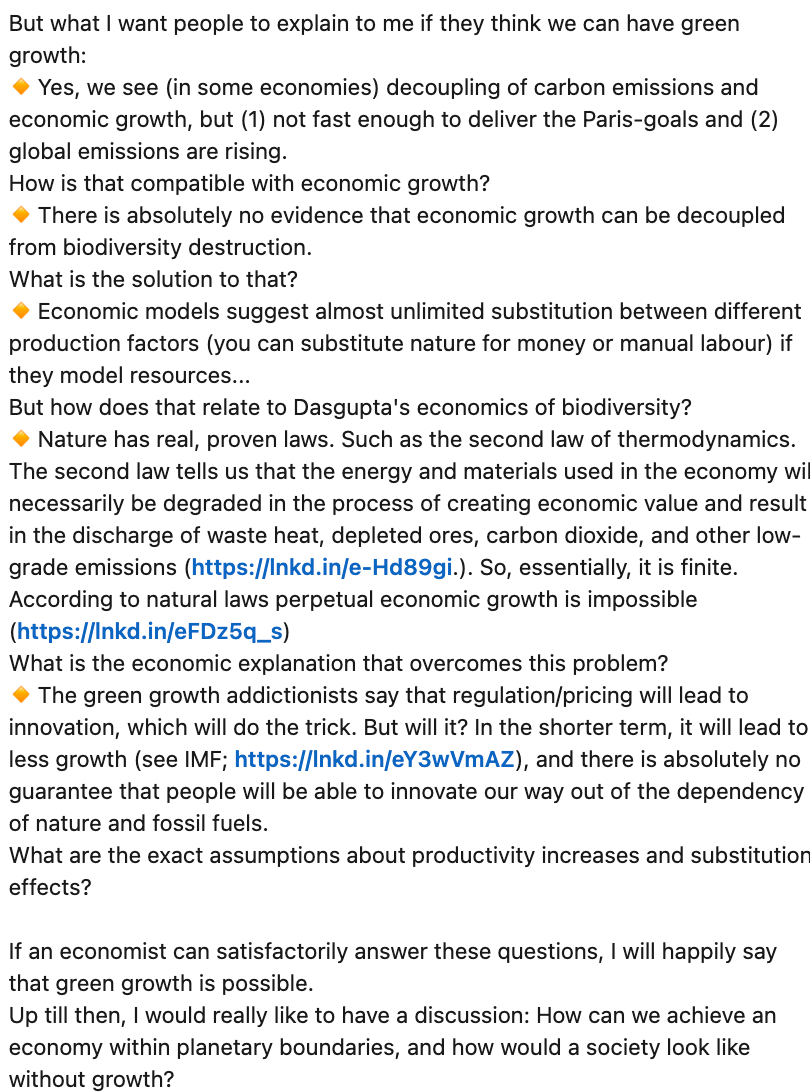

This is doubtlessly a huge challenge, but the ambition is well worth it, as this fantastic infographic by the World Wildlife Fund (WWF) shows, by comparing the stark difference in impacts between 1.5°C and 2°C of warming:

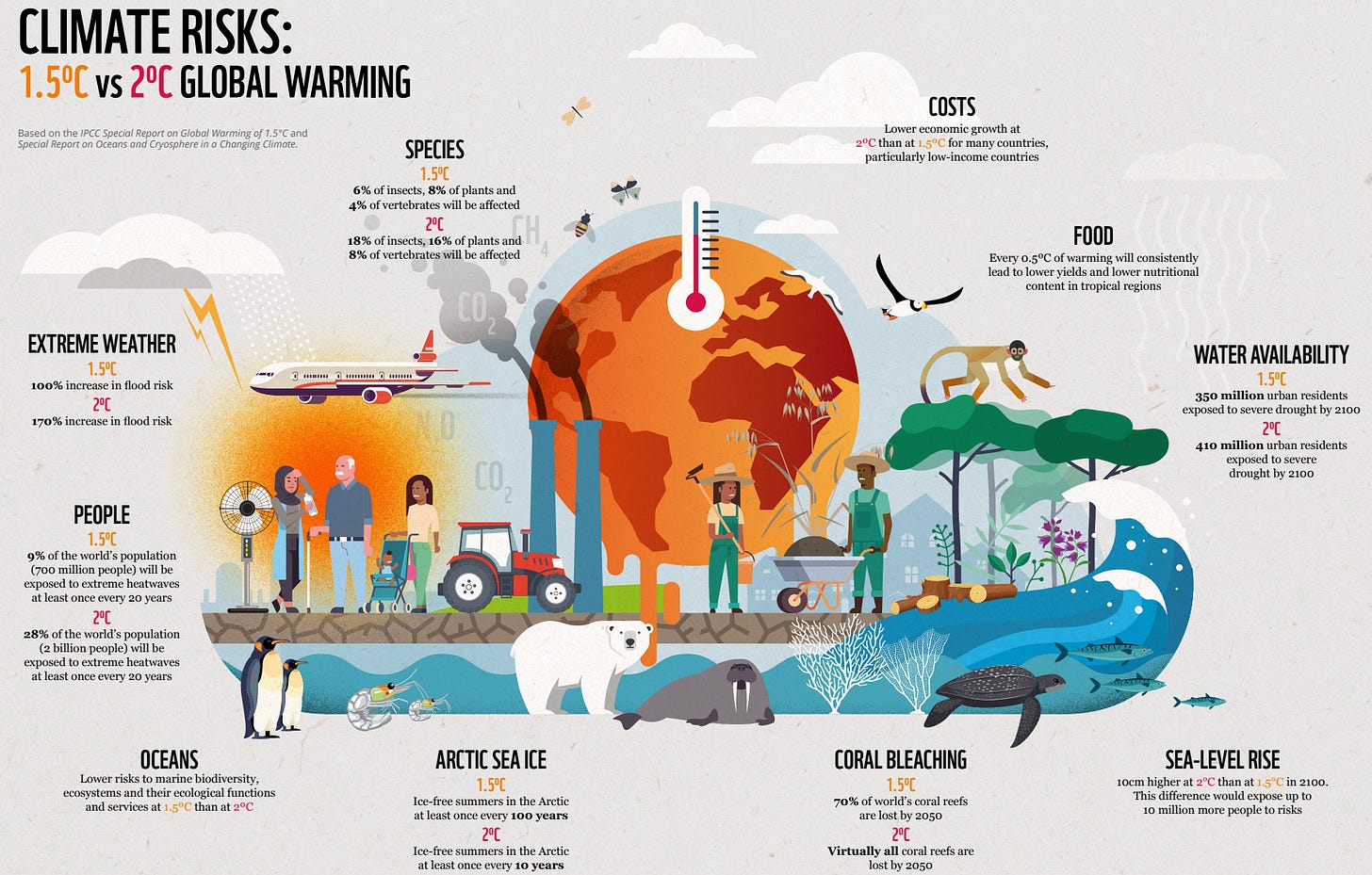

How Wall Street’s fossil-fuel money pipeline undermines the fight to save the planet

📰 Teaser: Big banks and investment firms have joined the ranks of companies making "net-zero" pledges. But their huge stakes in oil and gas projects undermine their climate promises → continue reading (24 min) …

Max‘s two cents: The green transition has been hampered by insufficient funding from the private and public sectors alike. The supply chain challenges with regard to fossil fuels caused by the war in Ukraine are now being used by financial institutions, fossil fuel companies, and governments to argue for continued investments in fossil fuel infrastructure.

Such arguments ignore the long life span of fossil fuel infrastructure, which is likely operational for a few decades. This is inconsistent with any realistic decarbonisation plan that would at least limit global warming to 2°C, which would not be an advisable goal anyway (see WWF infographic above).

Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our pathway, and no new coal mines or mine extensions are required.

As the 2021 report “Net Zero by 2050 - A Roadmap for the Global Energy Sector”, the International Energy Agency (IAE) pointed out, fossil fuel investments need to end, and investments in renewable energy infrastructure need to grow by order of magnitude in the coming years.

Governments need to provide credible step-by-step plans to reach their net zero goals, building confidence among investors, industry, citizens and other countries.

It is, therefore, little surprise that one of Germany's most sustainable banks, GLS Bank, recently left the Glasgow Financial Alliance for Net Zero (GFANZ) to protest the other members’ hypocrisy.

Ultimately, government action is necessary to guide markets, as the inadequacy of voluntary commitments such as by the Glasgow Financial Alliance for Net Zero (GFANZ) makes clear. Governments can shape the market context within which investment decisions are made. As private market forces and the financial sector, in particular, are affected by the “tragedy of the horizon” (in the words of Mark Carney), adjusting the current market context to be aligned with rapid decarbonization is essential. Carbon taxes, mandatory climate risk disclosures and management, and climate transition plans are initial good steps.

Not yet enough? Here are some evergreens and recent content we came across:

📅 Rethinking is timeless. Read January’s issue.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

🌱 The renowned journal Nature published a comprehensive article on degrowth.

🇳🇵Nepal handed over its national forests to community forest groups, which resulted in a 26-45% increase in forest cover.

🌳 Forests flourish under community control, and NASA has the satellite imagery to show it.

🤖 ChatGPT and other text-focused generative AIs could use a “watermark” in the text it generates to label AI content.

Leaving you with a quote at the end of the first issue:

You came across something we might want to read/listen/watch? Send it to us or leave a comment.

We hope you enjoyed it. Let us know & subscribe.

All the best, and keep rethinking