Rethink° February

Let’s talk impact startups, natural hydrogen deposits to fuel the green transition, questionable messaging on plastic recycling, and chocolate's climate challenge

Before we start: If you live in Europe, you can choose to go green with your search engines this week. This week, 500 million Europeans will 𝐩𝐫𝐨𝐚𝐜𝐭𝐢𝐯𝐞𝐥𝐲 be asked by Google and Apple if they want to switch their search engines due to the Digital Markets Act (DMA). You could use that to switch to Ecosia, a search engine that helps you plant trees 🌳🔎. (More Info on the DMA) and a Linkedin-Post about the upcoming event.

We talk quite a bit about impact and sustainability in this newsletter. But what this impact-thing?

Let’s get it going with impact startups

In my bubble everything seeks to be or to have impact—especially startups. I started digging into the literature and find out what impact actually is. Here is a brief abstract from the research:

What does it mean to be an impact startup? You have to be intentional about your impact, provide additional impact, measure it and be financially viable:

1. Intentionality

The company is set up with the intent to deliver a social or environmental benefit. The benefit is clearly distinct and contributes to a specific social or environmental challenge and can be linked to a specific stakeholder group.

2. Additionality

The benefits provided do have to be material to the receiving stakeholder and directly linked to the company’s action. The outcome and the linked benefits further must not have occurred without the company’s action.

If a startup, for example, helps firms to comply with environmental regulatory standards, the additionality could be questioned, as compliance with those new standards would have to occur with or without the startups action. The principle of additionality accordingly would require startups to provide benefits that go beyond regulatory and industry standards.

3. Measurability

The social and environmental outcomes and resulting benefits must be measured and benchmarked against the company’s intention. These measurements must be transparent, so the company can be held accountable. A net benefit should be eminent.

4. Viability

Impact startups aim to create self-sustaining business models that provide long-lasting effects and generate adequate financial resources to sustain operations. Impact baked into the viability of the business model to prevent short-term sacrifices of impact for financial return. Impact and financial returns are equally important.

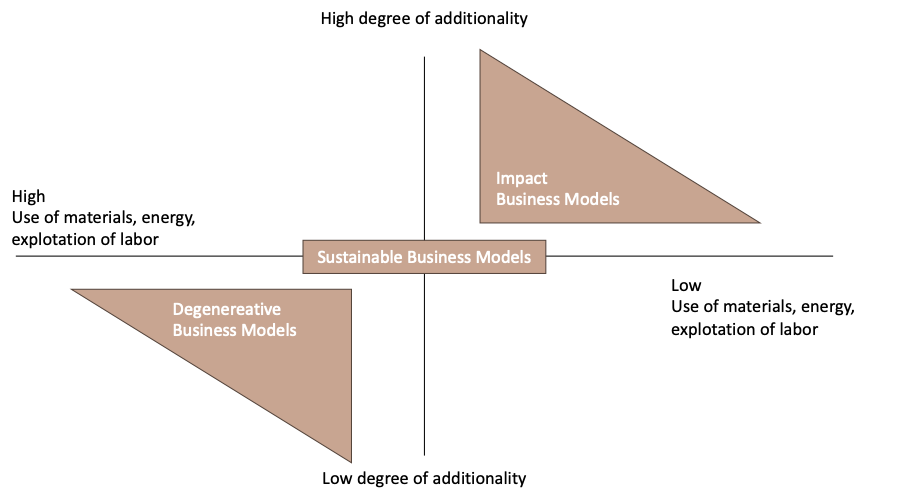

This is, then, how that could look compared to other types of business models:

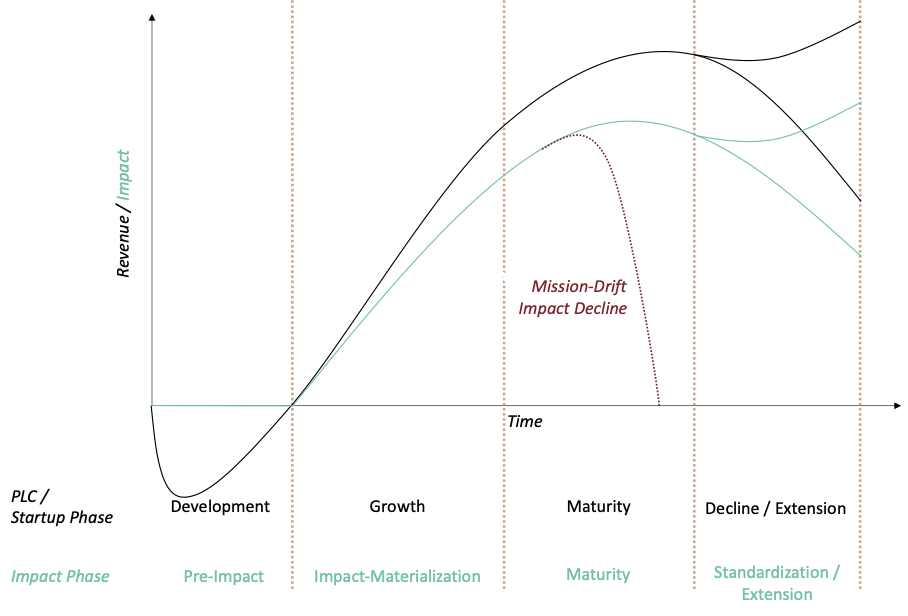

But Impact rarely stands on its own. So let’s add a timely dimension to it:

The timely phases of impact could be understood as follows.

Phase 1: Pre-Impact

In the initial phase, startups are in the ideation and testing phase, working to identify their market fit. At this stage, their potential impact is more of a hypothesis than a proven outcome. They won't yet have measurable results or a financially viable business model. However, their intention to address significant challenges (the UN SDGs?!) sustainably is crucial. Developing a plan for measurability and a strategy for creating impact is essential.

Phase 2: Impact-Materialization

During this phase, startups begin executing their impact strategies, transitioning from planning to action. They start to generate social or environmental benefits, alongside finding a commercial market fit, indicating demand for their product. Revenue and measurable impact start to increase, moving the startup towards financial viability and demonstrating their added impact. This phase turns hypotheses into measurable outcomes, highlighting the importance of clear metrics. The risk of mission drift, where impact and revenue goals diverge, becomes a concern.

Phase 3: Maturity

In the maturity phase, startups become established entities, consistently generating impact alongside financial returns. Their impact strategies are fully integrated, offering steady benefits against their chosen challenges. This phase marks the peak of their impact and financial model's sustainability, with all four key aspects (intentionality, additionality, measurability, and viability) firmly in place. However, the risk of mission drift remains, especially if compromising impact objectives could lead to higher revenues.

Phase 4: Impact Standardization

Finally, when an impact startup's practices become industry standards, it enters the Impact Standardization phase. The unique benefits and innovations it introduced become common, leading to a plateau in impact growth. This phase requires the company to innovate and redefine its impact goals to maintain relevance and continue delivering benefits. Achieving this standardization is a collective effort, reflecting broader industry or societal changes. Btw. do you have any good examples for that beyond legislations?

Facing the Risk of Mission Drift

Mission drift is a common risk for social enterprises, potentially occurring as they mature and strive for financial viability. To prevent this, closely aligning the business model with impact objectives is crucial. Instances of mission drift can be seen in various organizations that shift focus from their original missions to pursue higher profits.

What do you think of this definition of impact?

Sources:

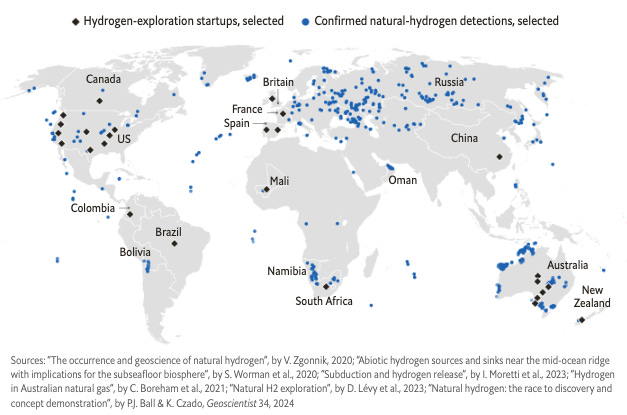

Geologists signal start of hydrogen energy ‘gold rush’

📰 Teaser: Geologists are signalling the start of a new energy “gold rush” for a previously neglected carbon-free resource — hydrogen generated naturally within Earth. As much as 5tn tonnes of hydrogen exists in underground reservoirs worldwide, according to an unpublished study by the US Geological Survey.

Continue Reading (→ Financial Times; 3 min)

🤔 Max two cents: Hydrogen has ridden multiple hype cycles over the past decades as a potentially green and versatile fuel. While hydrogen-powered planes and cars probably won’t be around the corner, and not even the block because of its high production costs and challenging storage requirements, it has a definitive role in decarbonizing heavy industry. As tempting as tapping into vast and cheap natural-hydrogen is, a key issue that would need to be accounted for is leakage. Hydrogen is 11.6 times more potent in terms of Global Warming Potential (GWP) than is CO2 over a 100-year period. Furthermore, while fossil fuel companies have a dismal record in terms of safe and socially beneficial extraction and governance practices, it is those companies are set to benefit from more drilling to fuel a hydrogen-based green future…. This does not seem right, but it might just be the ambiguity and complexity of a sustainability transition….

‘They lied’: plastics producers deceived public about recycling, report reveals

📰 Teaser: Plastic producers have known for more than 30 years that recycling is not an economically or technically feasible plastic waste management solution. That has not stopped them from promoting it, according to a new report.

“The companies lied,” said Richard Wiles, president of fossil-fuel accountability advocacy group the Center for Climate Integrity (CCI), which published the report. “It’s time to hold them accountable for the damage they’ve caused.”

Continue Reading (→ The Guardian)

🤔 Moritz’ two cents: Lies, lies lies. I remember the campaign by Coca-Cola calling consumers to throw away your plastic trash, otherwise you—the consumer—were polluting the environment. It’s time to make the plastic producers to be responsible for their waste, not the consumer. I’d say we should hit them where it hurts them hardest: money! If your product has the cradle-to-grave mentality, you’d pay for cleaning it up later when you make it available. That penalty could help reusable systems become the lucrative solution way faster.

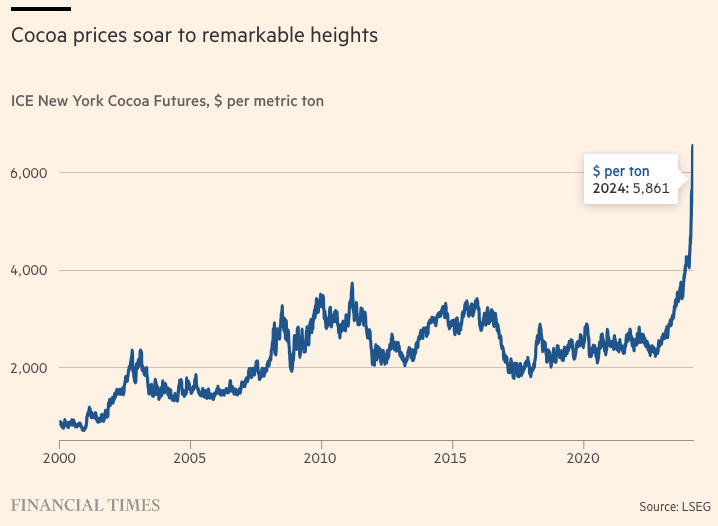

Why the cost of chocolate will keep rising?

📰 Teaser: The cost of chocolate is expected to continue rising due to several factors, including climate change, supply chain issues due to underinvestment in the past decades, and growing global demand. Last Tuesday, cocoa futures in London traded at a record high of £5,827 a tonne, up from £1,968 on the same day last year. While the price surge is a boon for middle men, the unequal distribution of profits undermines long-term supply stability.

Continue reading (→ Financial Times; 4 min)

🤔 Max’ two cents: The COVID-19 pandemic taught as a lot about the importance of resilient supply chains. Currently, the attacks on ships in the red size by Houthi rebels is highlighting how fragile our globalized economy is to supply shocks. Nevertheless, climate change represents a challenge at a global scale. Shifting weather patterns and starker weather extremes threaten agricultural production globally, from cocoa and coffee mainly in Africa and South America, to wheat production in the Middle East and soy and rice in Asia. As mentioned in the January edition, new crop varieties and alternative farming practices will help to mitigate some climate change induced losses. Still, for farmers to adapt, they are in urgent need of a greater share of the profits. Small-holder agriculture is a low-margin business, but those low-margin do not allow farmers to invest in new varieties, to learn new farming practices or to experiment themselves. We need to pay more attention to the people proving us with the produce that is fueling our pleasant, globalized lifestyles. Fairtrade is not perfect but better than nothing. If possible, consider direct trade alternatives such as Coffee Circle or Tony’s Chocolonely for some social businesses. How would you judge their impact following Moritz’s impact business models 101 at the beginning of this edition?

📚 Rethink° Book Club

Please share with us what you are reading.

Moritz: I read the book “Breath” by James Nestor. It’s basically how breathing better can make you healthier. My favorite review sums up the book as follows, “One GR reviewer calls this “4 parts good info and 1 part crackpot,” which I think is fair. Maybe even a little too kind -- I'd call it 3 parts good info, 1 part chat & anecdotes,”. My key takeaway: Breath through the nose. Whenever possible. 😤

Max: The past month, I read/listened to the audiobook “Piccola Sicilia” by Daniel Speck. It is the prequel to “Jaffa Road”, which Moritz already read last year. I enjoyed the book, despite some long-winding passages. I used to be a history buff as a child, and still prefer historical fiction when reading fiction at all. My key takeaway from the book is the insights into pre-war North African society in Tunis, which appears to have been harmonious and integrated across religious lines. As soon as I’d finished the book, I picked up the sequel, “Jaffa Road”, which focuses on the time of the creation of the state of Israel. For a very in-depth and detailed depiction of the politics and societal shifts that led to the current precarious borders in the Middle East, I can recommend “A line in the sand” by James Barr. Lengthy and at times a heavy reading, but worth your time if you are keen to get a more profound understanding of the lasting conflicts and tensions in this region.

Send us your recommendations, and we’ll list the highlights: me@mjmey.com

Not yet enough? Here are some evergreens and recent content we came across:

🎧 Outrage and Optimism on climate policy and action by the chair of the Paris Climate Agreement Christiana Figueres, Tom Rivett-Carnac and Paul Dickinson.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🎥 Water Bear is a non-profit movie platform focused on advancing activism, as a Netflix for impact.

📅 Rethinking is timeless. Read our January issue.

Have you encountered something we might want to read/listen/watch? Please send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe, and share.

All the best, and keep rethinking,