There is a noun that we have mentioned in every episode so far. Can you guess it? It’s carbon. So it’s about time to make an episode about it.

Are you a member of the Church of the Earth?

Or simply put: How do you compensate your footprint?

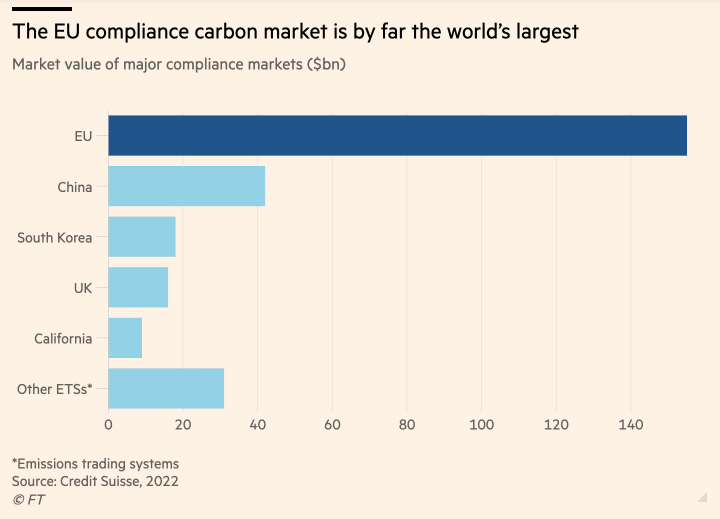

There are two different ways to carbon credits. There are the voluntary carbon offsets and the involuntary ones. The voluntary ones come in many forms and are basically a letter of indulgence – a forgiveness of your carbon sins. And these letters are in high demand, availability of tons to offset jumped from 200 million to 500 million with a monetary value of US$ 2 bn (Carboncloud). The involuntary markets are – as you might imagine – compulsory. Those are national or international schemes where emitters (usually companies in certain industries) have to buy a right-to-pollute. Governments set a max. cap of emissions, put them into credits and make them available for sale on a market. Popular examples are the Emission Trading Scheme (ETS) of the European Union, and most recently Chinas ETS that covers 1/7th of carbon emissions (UNDP).

So, if you are a company being a part of the ETS you do not have a choice, you’ll have to buy the right to emit, and you are in competition. But you are not only in competition with other polluters, you also compete with unexpected player.

Speculators

I’d be the first to call out speculators on markets as the bad that drive up prices artificially. But there’s an exception to every rule. The EU ETS is a constructed market and the prices were too low to be effective, according to various papers (OECD, Bloomberg, PIK). But speculators drove up the price (among other factors) and polluters (that have not been buying credits in bulk before) will have to pay more to pollute (nice!). And you know what? You can actually be part of the speculation – or of the investment – however you want to call it, with Carbon ETFs. Just make sure that they are physically replicating (actually buying) to have an impact. One example is the HanETF.Offsetting

Did you see that coming?

The voluntary and involuntary carbon markets are starting to mingle. Instead of planting trees, saving peatlands or donating for more efficient energy use, like most of the voluntary offsets, you can simply take away someone else’s right to pollute. I actually found that really convincing, so chose that method to compensate. But be aware, it’s more costly than planting trees in a low-wage country. I opted for ForTomorrow to cancel emission rights, but there might also be others.

And now that we have talked so much about offsetting your carbon footprint. How about you start…

Stop Obsessing Over Your Carbon Footprint

📰 Teaser: There are many ways to make progress on climate change that have more impact than that one takeout container you failed to recycle. There’s a famous 2016 cartoon by Matt Bors, which has since become a meme, in which a medieval peasant says, “We should improve society somewhat.” A smug man, trying to catch the peasant in hypocrisy, responds, “Yet you participate in society! Curious!” When it comes to climate change, too many of us have internalized the smug man.

🤔 Moritz’ two cents: The article is an opinion piece, and it’s worth a read. It highlights one of the core problems that many wealth researchers address: unfair distribution of wealth and carbon emissions: “The world’s richest 1% of earners emit about 1,000 times the carbon of the poorest 1%”. So who are we to care about our footprint, right?

The richest 1% are individuals with more than $1 million in wealth (Oxfam). But even if you do not have a net worth of $1 million, we should admit that the average western lifestyle is closer to the richest 1% than it is to the poorest. So, yes we might stop obsessing over the carbon footprint and also focus on other areas (a.o. impact investing, political activities, donations and where & how we work). On the other hand, we mustn’t ignore it. There will be areas of our life where knowing the carbon footprint will help us to rethink and reconsider whether that is really a necessary thing to do or product to purchase.

Can carbon markets accelerate progress towards net zero?

📰 Teaser: Growth has come with scepticism and implementation challenges, but recognition of the trade-offs involved is unleashing a wave of innovation to increase supply and improve transparency.

The voluntary carbon markets are by no means the primary means of reducing or removing greenhouse gas emissions, but they can be a meaningful complementary tool in getting to our net zero goals

_ Annette Nazareth, Chair of the Integrity Council for the Voluntary Carbon Market

🤔 Max’ two cents: This article from the FT Moral Money Forum provides extensive coverage of the current state and challenges of regulatory and voluntary carbon markets. While carbon offsets are by no means sufficient and perfect vehicles to advance the decarbonization over the coming decades, they are one (unfortunately) hype partial solution. Simple stories are more likely to catch on, but rarely exist in reality. The same is true for carbon offsets, which went through the hype cycle over the past few years, with initial enthusiasm and in the past two years, the right amount of scrutiny that peeled off the knight’s shiny armor. While many renowned climate experts and economists agree that regulatory carbon markets, such as the Emission Trading System (ETS) of the European Union, are one of the most effective policy levers to drive decarbonization, many also agree that it is no silver bullet. Intentional carbon market design is challenging to get right, especially under the influence of powerful industry lobbies and electoral dynamics. Furthermore, given the systemic shifts that are required to bring humanity within the planetary boundaries, of which decarbonization is just one dimension, carbon markets cover just a small fraction of the addressable challenges.

In summary, carbon markets and offsets voluntary and regulatory are a useful tool to channel financial flows towards decarbonization measures. Yet offsets are no solution in isolation, they should always receive scrutiny with regard to the underlying additionality, and be never hyped as a silver bullet solution to continue business as usual and let others handle the decarbonization effort.

Unpacking ton-year accounting

📰 Teaser: The text delves into the concept of ton-year accounting and its relevance in calculating the cost of carbon dioxide (CO₂) emissions and the benefits of temporary carbon storage (such as trees). Ton-year accounting is a family of methods used to determine the ton-year cost of CO₂ emissions in the atmosphere by integrating a curve that represents the proportion of an emission remaining in the atmosphere over time. This integration helps estimate the extra energy trapped in the climate system by a CO₂ emission, known as cumulative radiative forcing. The concept of cumulative radiative forcing is utilized to establish equivalence between emitting CO₂ and temporarily storing it. The robustness of the methods used to establish this equivalence matters greatly in the design and quality of carbon offsets based on temporary carbon storage.

🤔 Max’ two cents: This article highlights the number of challenges that robust carbon offsets (and basically any other types of offsets) face. Trying to capture the complexity of earth system dynamics and uncertainty into a simple enough methodology to used to create cost-efficient, robust offsets. Imagine the challenge for biodiversity offsets, as we have a more limited understanding of the system dynamics that are determining the value of single biodiversity parameters, let alone their temporal consequences.

(Re)think beyond carbon

We talked a lot of carbon in the episode. So let’s end it with a brief call to look beyond. Because carbon is not the only thing we should be looking at, biodiversity or plastic pollution are just some issues that relate to the dimensions of our planetary boundaries as well. And there are ways to compensate there as well, that’s for sure (for everything that cannot be avoided).

Plastic Credits: everwave, plasticbank, repurpose

Biodiversity Credits: Do you know any good organization?

📚 Rethink° Book Club

Share with us what you are reading.

Moritz: I am currently reading “Utopia for realists” by Rutger Bregman. My takeaway so far : “It's us, the happy campers in Cockaigne, who need some fresh perspectives”- We live in the utopia of the 15th century (“Cockaigne”). We made it, so we can dare to go further, for a new utopia. Let’s define what it should look like.

Max: For the past months, I have been reading “Zen and the Art of Saving the Planet” by Thich Nhat Hanh preparing for a meditation retreat in Plum Village in France this August. It introduces the reader to Thich Nhat Hanh’s lessons from Zen for activism (especially climate activism). It does not simply provide new perspectives on the macro picture, but also concrete advice on mental health and resilience needed to be a compassionated activist working on intractable challenges.

Not yet enough? Here are some evergreens and recent content we came across:

📔 Any open questions on degrowth? You might find an answer in this book: “The political economy of degrowth” with 850+ pages by Timothée Parrique.

🤖 What can the Copernican Revolution Teach us about the Future of AI? A concise but insightful analysis by Azeem Azhar of Exponential View.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

📅 Rethinking is timeless. Read the May issue.

While I believe internalizing cost is a good thing. This made me thinking:

You come across something we might want to read/listen/watch? Send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe and share.

All the best, and keep rethinking,