Rethink° July

☀️ Summer Mode activated! You'll find books, we question clean gas and market designs, and it will get quite hot with wet-bulb temperatures.

This episode is in full summer mode, which is why it includes plenty of book references, so if your holidays are still ahead of you, you might find some ideas here. If you are back to your no-holiday routine, we’ve got you covered: the highlights are readable within a few minutes in this month’s episode. It’s on innovation, sustainable finance, and – well – books.

Who is paying for innovation?

📰 Teaser: According to conventional wisdom, innovation is best left to the dynamic entrepreneurs of the private sector, and the government should get out of the way. But what if all this was wrong? What if the public sector has been the boldest and most valuable risk-taker from Silicon Valley to medical breakthroughs? Read the book → (405 pages)

🤔 Moritz’s two cents: “The entrepreneurial state” by Mariana Mazzucato was a worthy summer read for me. It was an eye-opener, clarifying who pays for innovation and when. My takeaway was as follows:

The state is the most significant risk-taker; he comes in even before any financiers come in. The state finances early ventures and scientific research that lays the groundwork. Even central cooperation in Tech & Pharma were profiteers of state funding. The same companies that are now profiteers of tax loopholes. And therein lies a problem. Profits are often privatized, whereas the initial risks/losses are socialized. That is no proper risk-return ratio. The good thing: the 2011 book includes some policy suggestions, and having looked at recent government funding, I think, I saw some of those recommendations in place.

Is Sustainable Finance a Dangerous Placebo?

📰 Teaser: A new scientific paper by Heeb, Kölbel, Ramelli, and Vasileva looks at investors and whether sustainable investing has any placebo effects. They state the following: We find that the opportunity to invest in a climate-conscious fund does not erode individuals’ support for climate regulation. While sustainable finance resembles a placebo in that participants seem to overestimate its impact, it is not a dangerous placebo that crowds out political engagement. Continue Reading → (25 min)

🤔 Moritz’s two cents: I’ll keep it short. It’s nice to read that sustainable investors do not say, “My job is done now” after investing sustainably. However, as the authors correctly address, the worse placebo might be somewhere else: In product marketing and greenwashing. As in another study, the authors find that any shade of green is enough for the investor to feel happy or better about their investment. A darker shade of green does not improve their feeling and thus is not a strong motivator to keep hanging onto investing greener (click here for that paper).

How hot does it feel?

📰 Teaser: When a deadly heatwave hits India’s northern plains, some 20m people are killed by persistent “wet-bulb” temperatures of more than 35 °C (95 °F). That is the plot of “The Ministry For the Future,” Kim Stanley Robinson’s novel about climate change. The scenario is fiction, but similar temperatures have been briefly recorded in the real world. And as the globe warms, they will become more common.

See the video → (16 min) or Continue Reading → (3 min) [Paywall]

🤔 Moritz’s two cents: When I first saw the video, I was reminded of the book mentioned in the article, “The Ministry For the Future” (already mentioned in this issue). In short: Wet-bulb temperature is a measure that combines air humidity and temperature. This is the temperature we perceive because our bodies can cool down better with low humidity.

The risk of high wet-bulb temperatures is so striking that it has been sticking with me for the last two weeks. We are heading towards (just another) vicious circle. There will be places on Earth where our natural cool-down system will not work anymore. What will we be relying on then? Air-conditioning. Global energy demand from air conditioners is expected to triple by 2050, requiring new electricity capacity the equivalent to the combined electricity capacity of the United States, the EU, and Japan today (IEA). Uffff…

Leaks Can Make Natural Gas as Bad for the Climate as Coal, a Study Says

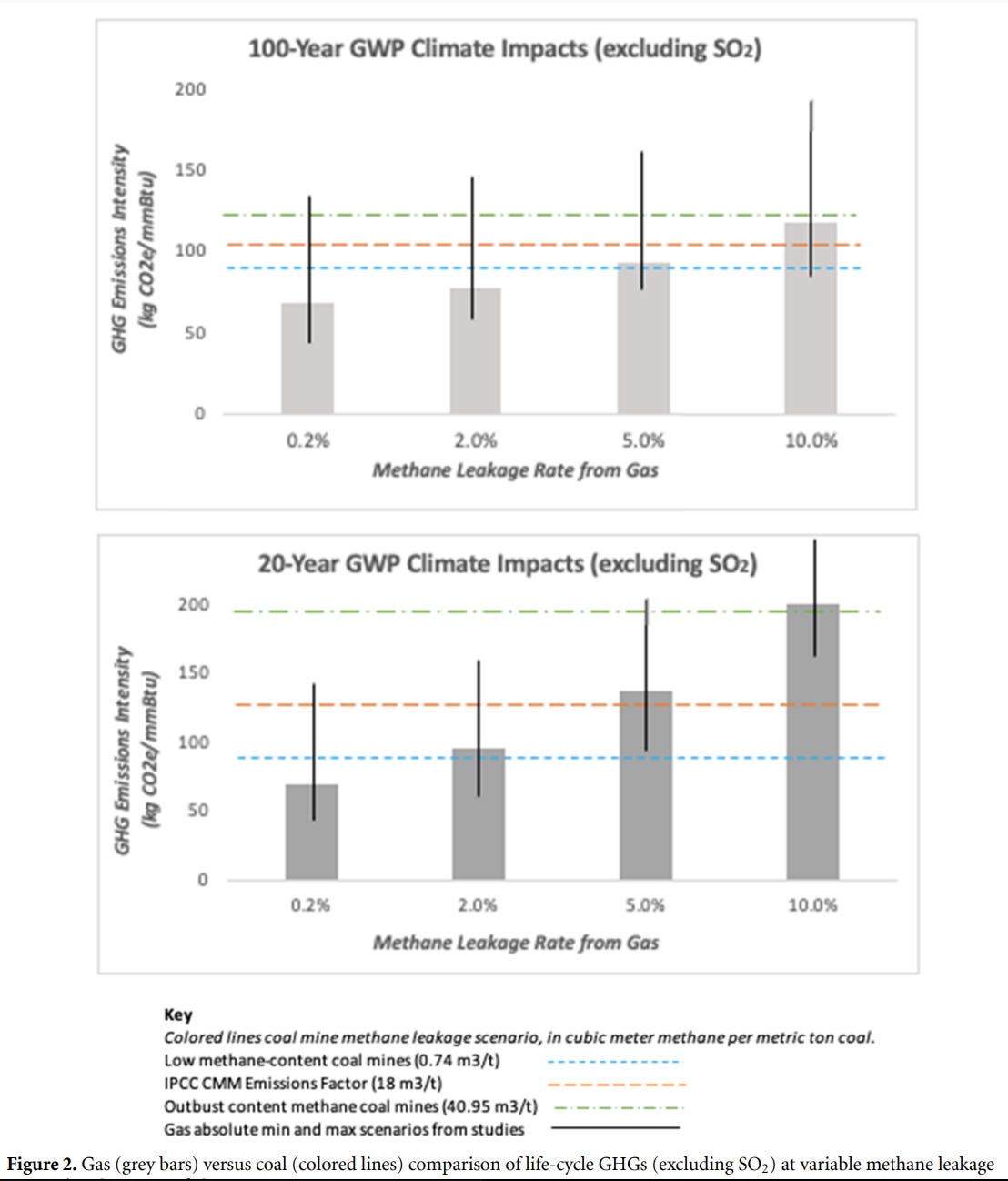

📰 Teaser: The peer-reviewed study, which also involved researchers from Harvard and Duke Universities and NASA and is set to be published next week in the journal Environmental Research Letters, adds to a substantial body of research that has poked holes in the idea that natural gas is a suitable transitional fuel to a future powered entirely by renewables, like solar and wind.

🤔 Max’s two cents: “Natural”/ fossil gas is not a transition fuel! Long seen as a cleaner alternative to coal and an essential tool in the fight to slow global warming, it can be just as harmful to the climate unless companies can all but eliminate the leaks that plague its use. As little as 0.2 percent of fossil fuel gas leaks, making natural gas as big a contributor to climate change as coal. This matters especially over the next 20 years, as the average lifetime of methane is 12 years in the atmosphere (with an order of magnitudes more radiative forcing than CO2). Thus, subsidizing the switch to fossil gas as a so-called “transition” technology is a dangerous distraction. Furthermore, stringent regulations and monitoring are required to limit methane emissions. Luckily, remote sensing technologies for planes or satellites are advancing fast, enabling timely tracking of methane leaks along the fossil gas infrastructure.

The fossil fuel industry will not lead us out of the climate crisis

📰 Teaser: How should Shell or Saudi Aramco respond to the record-shattering rise in global temperatures at what appears to be just the start of a severe warming El Niño event? These questions are more acute than ever for any company whose financial lifeblood comes from fossil fuels — the oil, gas, and coal that are the most significant contributors to global warming. Continue Reading → (3 min)

🤔 Max’s two cents: Ultimately, we cannot expect the fossil fuel industry to lead us out of a crisis caused by fossil fuels. Only governments can cut demand for these fuels through an intentional market redesign. Free markets do not exist in a vacuum but rely on regulatory exoskeletons that determine fundamental incentive structures.

📚 Rethink° Book Club

Share with us what you are reading.

Moritz: I just finished “Originals: How Non-Conformists Move the World” by Adam Grant, a lovely book on creativity and what makes a creative person. Though, it is more explanatory. If you want to be more creative, read “How to Fly a Horse.” And for now, I am off to some holiday reading: The fantasy series “Stormlight Archive” by Brandon Sanderson.

Max: I am still reading “Zen and the Art of Saving the Planet” by Thich Nhat Hanh, preparing for a meditation retreat in Plum Village in France this next week. It is an introduction to Thich Nhat Hanh’s lessons from Zen Buddhism for activism (especially climate activism). It does not simply provide new perspectives on the macro picture and concrete advice on mental health and resilience needed to be a compassionate activist working on intractable challenges.

Not yet enough? Here are some evergreens and recent content we came across:

📔 Any open questions on degrowth? You might find an answer in this book: “The political economy of degrowth” with 850+ pages by Timothée Parrique.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

🤖 What can the Copernican Revolution Teach us about the Future of AI? A concise but insightful analysis by Azeem Azhar of Exponential View.

📅 Rethinking is timeless. Read the June issue.

Read the context of the quote here (it’s worth it).

Have you encountered something we might want to read/listen/watch? Please send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe, and share.

All the best, and keep rethinking,