Rethink° October 🍁

Tax reports, Drought in the Amazon, the progress on our Sustainable Development Goals and private efforts to solve climate change. How did October go about?

Leaves are falling, autumn is coming, and a global tax report has been published. This time we are taking a look at justice on taxes, taking an unexpectedly shallow dive into the Amazon, and look how we progress (too slowly) on the Sustainable Development goals. We also figure out whether the corporate world is set to save us all. Let’s get going.

The Global Tax Report is out

📹 Teaser: Billionaires have been operating on the “border of legality” in using shell companies to avoid tax and the world’s 3,000 wealthiest individuals should be charged a 2% levy on their wealth, a research group created to inform EU tax policy has claimed. Continue Reading (→ Guardian; 3 min)

Read the Report (→ Well it’s a report, that takes some time)

🤔 Moritz’ two cents: It’s nice to have it on paper again and backed by new research: rich people are avoiding taxes. The German Newspaper Zeit even titled its article on the tax report “The tax rate of billionaires? 0.5 per cent!” (Paywall). The renowned economist Stiglitz also has some words for it: “Tax evasion, and, more broadly, tax avoidance, is not inevitable; it is the result of policy choices – or the failure to make policy choices that act to stop it.”

It is weird to me that we claim to live in a democracy where all people ought to have an equal level of influence. As it seems, some are more equal than others, especially if they own more money. I, personally, do not think that we need to accept extreme accumulation of money or wealth in our society. It is a paradigm that we are currently choosing to accept within our story of capitalism, but it is not a law of nature. We do not have to accept large amounts of accumulated wealth as a matter of justice. We – as a society – could decide for restraints of the usage of wealth (“in societies favor” as some constitutions already require) or at least reverse the resistance to capital accumulation. Currently, resistance for accumulation is highest in the beginning. It is common to hear “the first million is the hardest”—shouldn’t it be the easiest? Because that would help to narrow wealth inequalities. Which is a major issue of our time (Manchester University) and it can lead to social unrest (Houle et al, 2022). The rise of extreme political forces here in Europe might just be one result of that.

And if happiness peaks at an income of around 100,000 USD, what’s the matter in having significantly more? I will stop elaborating further here and refer to my favorite video of a Davos conference. You could call it “taxes, taxes, taxes”. It’s not that we did not know, it’s simply that we do not act.

Amazon water levels hit record lows as drought worsens

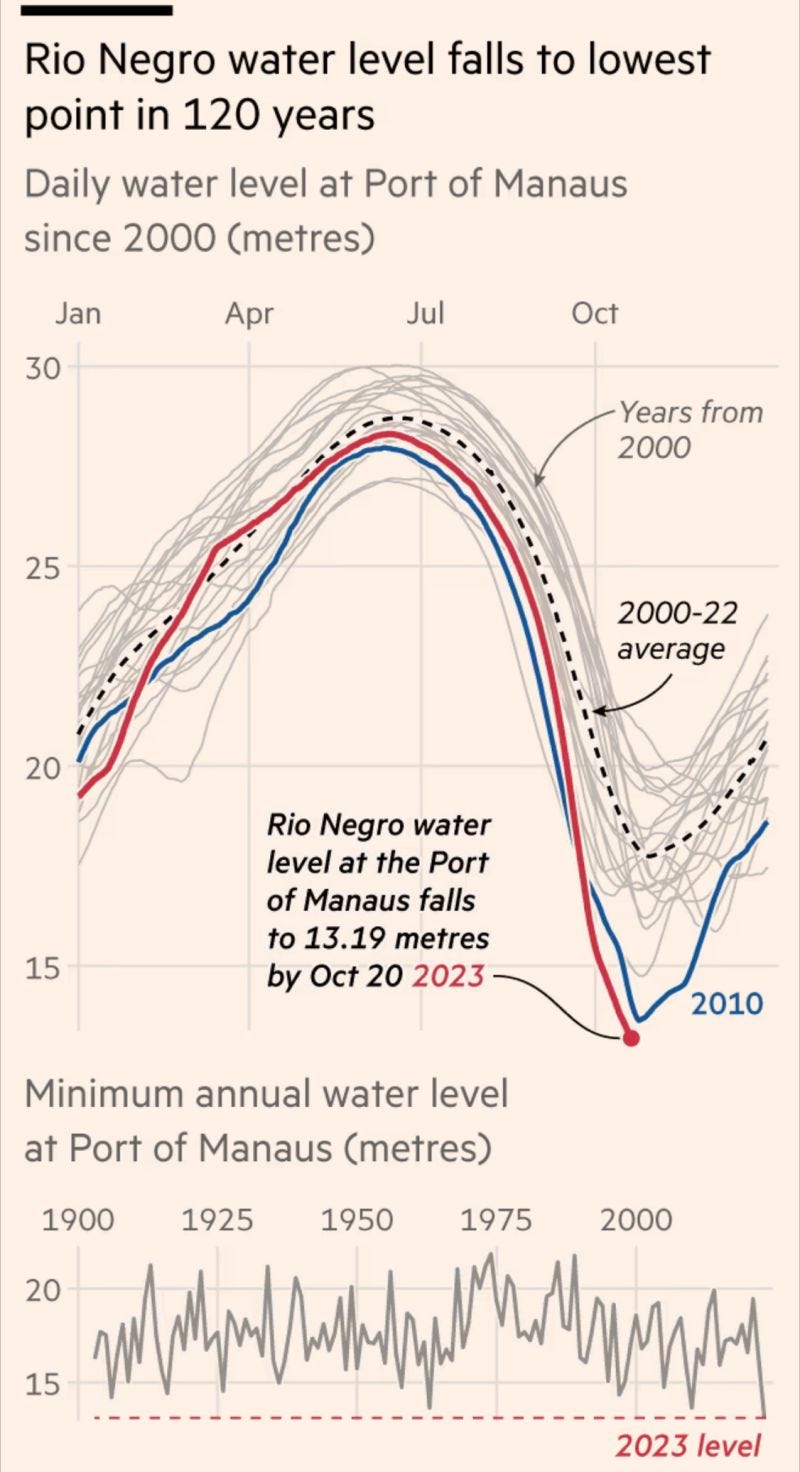

📰 Teaser: Rivers in the Amazon rainforest have dropped to record low levels as one of the region’s worst ever droughts is amplified by the onset of El Niño. With some areas already experiencing over two degrees of increase in average temperature, this drought foreshadows what the coming decades will look like unless drastic carbon drawdown is achieved. Continue Reading → (Financial Times; 3 min)

🤔 Max’s two cents: I am a fan of the visualization in the FT, but this one shocked me more than I’d expected, given that I’ve been following climate news for many years. The Amazon Rainforest dieback is one of the nine global climate tipping points. It refers to the unstoppable process of forest dieback that is triggered once a critical area of rainforest has been cleared. It is unstoppable, since the Amazon depends on its self-created water cycle.

This water cycle exists because forested area not only draws down carbon from the atmosphere, and provides habitat to about 10% of all species known on Earth, but also causes evaporation of water. This evaporated water forms clouds, which rain down on the Andes mountains, which feeds the rivers that water the Amazon forest. You get the cycle...

Now that roughly 20% of the Amazon rainforest has disappeared, we might already be approaching a tipping point. Evaporation is reduced to such an extent that whatever water is provided in the form of rain is insufficient for the forest to survive. This breaks the water cycle, causing continued dieback of forest.

The onset of the El Niño weather phenomenon further reduces rainfall in this part of South America. Therefore, deforestation must stop now, and reforestation needs to take place wherever possible.

Luckily, we are seeing some progress being made at integrating considerations for biodiversity and nature more broadly in economics and in particular in finance. In September, the Task Force for Nature-related Financial Disclosures published its final recommendations on positioning nature risk alongside financial, operational and climate risk, as a mean to shift capital flows to nature-positive outcomes. Nevertheless, it is very challenging to find accurate and operational metrics for biodiversity, given inherent complexities in ecosystems.

Are we at a point where we need to accept that indigenous wisdom, values, and world views, are more practical than reductionist metrics? Should we finally accept that we as humans are just part of nature and that we live in a complex system of interdependencies, that requires us to stop destroying ever more ecosystems. Instead of pushing for less harmful ways of continued expansion on a finite planet, we ought to stop expansion (and therefore destruction of ecosystems). Let human ingenuity run wild on how to best use what resources we have already extracted and the lands we have already cultivated.

Progress report on the UN Sustainable Development Goals

📰 Teaser: According to the report, the impacts of the climate crisis, the war in Ukraine, a weak global economy, and the lingering effects of the COVID-19 pandemic have revealed weaknesses and hindered progress towards the Goals. The report further warns that while lack of progress is universal, it is the world’s poorest and most vulnerable who are experiencing the worst effects of these unprecedented global challenges. It also points out areas that need urgent action to rescue the SDGs and deliver meaningful progress for people and the planet by 2030. Continue Reading → (80 pages, but nice visuals)

🤔 Moritz’ two cents: The report was published in July, but I came across it and it shocked me. Well, did it really shock me? It should have, but I was not surprised by what I saw.

A mere 15% of the goals are on track, 48% off track, and the last 37% are in stagnation or regression. Yet to mention, the goals were published in 2015 and should be reached until 2030. It’s half time and it does not look good. It worries me accordingly that this report did not get more attention because I believe we should give it more attention and ramp up the efforts. While it is easy to write that, it is harder to act on that, of course. Which is why agreeing on the goals in 2015 was possible, but reaching them, as we see, is way harder. One avenue to take is to ramp up entrepreneurial efforts, redirect money towards Schumpeterian creative, sustainable destruction and to back that with the right policy efforts. Because remind me again, who is consuming most of our Co2 budget? It’s the people we fail to tax properly (Oxfam).

For reference, we had a go on that in an earlier episode.

Can sustainable development and climate action rely on the private sector?

📰 Teaser: Since the 2009 COP climate summit, at which wealthier countries committed to contribute $100 billion annually in climate finance to poorer countries, contributions have remained well below this threshold. Already ahead of the Paris COP in 2015 integrating the private sector in climate talks gained recognition, with the Lima Paris Action Plan. With mounting climate change impacts increasingly at odds with tight international resources, there has been a growing expectation that private finance will pitch in. Just how realistic is this? Continue Reading (→ Geneva Solutions; 9 min)

“Green investments in the short run may not be as profitable as some other investments, and there may be more uncertainty regarding profit, [..].It may be a challenge to mobilise funds unless regulation is changed. Asset managers may then face a conflict whether to comply with the regulations or do something else.” - Nathan Sussman, professor of international economics at the Graduate Institute

🤔 Max’ two cents: Hailing the private sector as this better version of the public sector makes me skeptical, as the fundamental values and world views that determine dynamics in the two tend to be the same. Furthermore, governments determine the regulatory context within which the private sector operates.

Therefore, I appreciated the quote by Nathan Sussman of the Graduate Institute in Geneva highlighting the importance of conducive regulation to grow climate finance. Innovative financing approaches like parametric insurances, adjustments to the World Bank's special drawing rights (SDR), carbon and other offset markets, and blended finance won't work as intended unless climate considerations are woven into the underlying structure of our global financial system.

Regulation in the EU, USA, and Japan (among others) to integrate climate risks and non-financial considerations (biodiversity, social, etc.) in risk management and mandatory disclosures are tentative steps in the right direction. Given the uncertainties and the diverging investment horizons, governments, central banks and probably pension funds seem best poised to contribute the 1-3 trillion USD of climate finance that is needed each year until at least 2050 to enable an inclusive transition.

Private climate analytics services may be ‘over-claiming’ accuracy

📰 Teaser: The booming private-sector climate data services industry is over-claiming its accuracy and failing to deliver equitable, reliable or transparent datasets. The common approach in climate risk modelling on asset level, so-called Downscaling, is the bottom-up process of using location-specific information to flesh out aggregate geographical data from publicly available global climate models. Downscaling aims to provide greater granularity and decision-useful information on physical climate risks. However, Downscaling often results in claims that are not sufficiently grounded on science. To improve the quality of data, more investment is needed in catastrophe modelling techniques. Continue Reading (→ Green Central Banking; 5 min or read the original paper)

🤔 Max’ two cents: The methods used to transform global, coarse climate models into detailed location-specific models for climate risk have caught my attention lately. Common global climate models operate on a 100 km * 100 km resolution, which makes it necessary to downscale their predictions significantly for those model to be operationalized. This level of granularity is necessary since investment decisions are made on an asset-level. Thus, coarser risk models would be more difficult to integrate in the investment decision process. Nevertheless, inaccurate predictions of climate risks pose a threat to companies, especially insurances, as I have written before. Furthermore, low-quality predictions also hamper the green transition since financing decisions will be based on inaccurate data, leading to suboptimal asset allocation and consequently slower decarbonization. The proposal in the paper for publicly owned and open-source national climate data services seems timely and effective, and be it only to develop regulatory capacity in climate risk modelling.

📚 Rethink° Book Club

Please share with us what you are reading.

Moritz: It’s getting spiritual. I have grabbed the book “The Power of Now” by Eckhart Tolle. I started reading it at the beginning of the year and put it aside again. It was a little too spiritual for my liking. Though, as I faced some personal challenges that brought me to rethink how I approach life, the book bears some wisdom, that now feels more accessible to me.

“The only thing you'll ever have is now.” is a quote from the book. We do live in the now, not in the past nor in the future.

Max: Two weeks ago I picked up the “Handbook of International Climate Finance” by Axel Michaelowa and Anne-Kathrin Sacherer. The book is useful to gain an overview of the current state, history, and mechanisms of global climate finance. The key insight for me so far is that high bureaucratic hurdles hampered disbursement of the funds made available through vehicles such as the Green Climate Fund (GCF). Furthermore, it is discouraging to read how over the past decades, despite any well-intended pledges to provide X amount of climate finance, governments have consistently fallen short of their promises and contributions. The next chapter is on the means to improve on the existing state of affairs, and I hope to finish it before COP 28 (30 November until 12 December).

Send us your recommendations, and we’ll list the highlights: me@mjmey.com

Not yet enough? Here are some evergreens and recent content we came across:

🎧 Outrage and Optimism on climate policy and action by the chair of the Paris Climate Agreement Christiana Figueres, Tom Rivett-Carnac and Paul Dickinson.

🗞️ The ESG on a Sunday newsletter is for everyone who wants to keep up with developments in sustainable finance.

🌍 Planet Critical is an excellent podcast for everyone who is into changing the world.

🎥 Water Bear is a non-profit movie platform focused on advancing activism, as a Netflix for impact.

📔 Any open questions on degrowth? You might find an answer in this book: “The political economy of degrowth” with 850+ pages by Timothée Parrique.

📅 Rethinking is timeless. Read the September issue.

Have you encountered something we might want to read/listen/watch? Please send it to us or leave a comment.

We hope you enjoyed it. Please comment, subscribe, and share.

All the best, and keep rethinking,

I am here, listening :)